01. Time Series Model: Factor Variance

M4 L2A 12 Time Series Risk Model Factor Variance V2

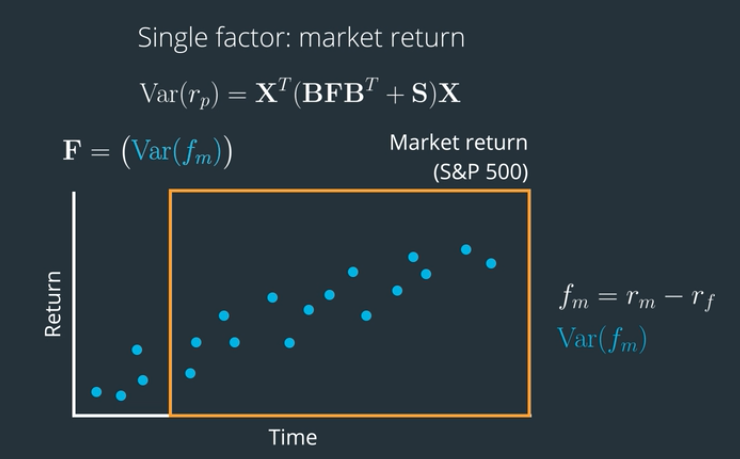

Covariance Matrix of Factors

We'll collect a time series that represents the chosen factor. In this case, our factor is "market excess return", so we can use an index (such as the S&P500) and subtract a time series that represents the risk-free rate, such as the three-month US Treasury Bill rate. Calculating the variance of this market excess return helps us fill in the covariance matrix of factors.